Imagine a company you’ve been following for years suddenly offering you a chance to own a piece of it. This happens during an Initial Public Offering (IPO) —when a private company decides to go public by selling its shares for the first time.

An IPO allows everyday investors like you to buy stock in a company that a small group of private investors or founders previously owned. An IPO is a major step for the company, providing them with the funds needed to expand, innovate, or even pay off existing debt. It’s a win-win: investors gain ownership, and the company gets the capital it needs to grow.

Now, let’s dive into how an IPO works, why companies do it, and what it means for investors and the company itself.

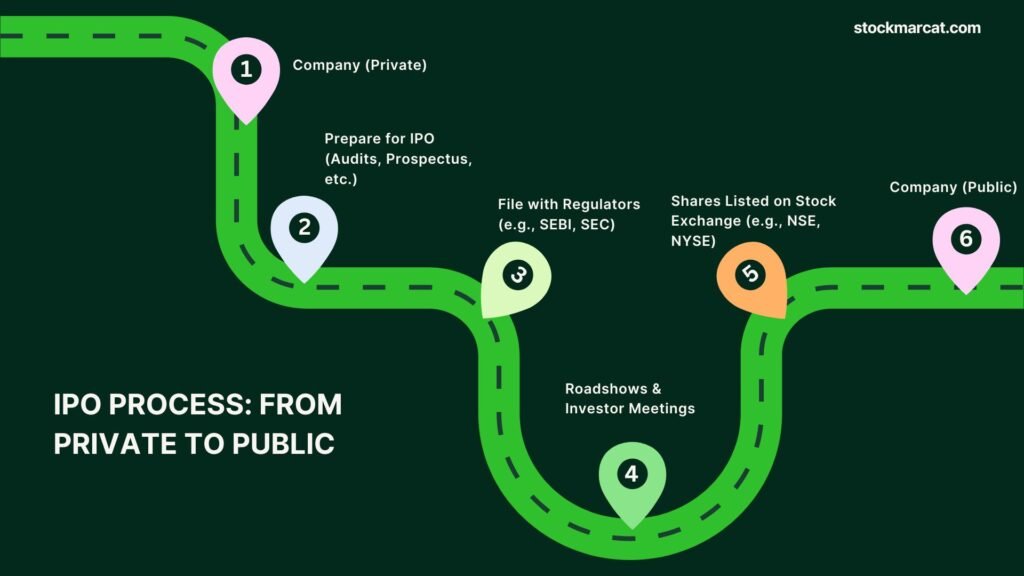

How a Private Company Becomes Public

Taking a company public through an IPO is a detailed and regulated process. Here’s how it works:

- Pre-IPO Preparation: Before starting the IPO, a company looks at its finances, business plans, and whether it’s ready for public attention. This step includes a lot of paperwork, financial checks, and sometimes changes to meet the rules set by authorities.

- Underwriting: The company hires investment banks to help with the IPO. These banks are called underwriters. They allow the company to decide what kind of shares to offer, how much money to raise, and what the share price should be. They act as a link between the company and potential investors.

- Pricing: After looking at the company’s finances and the market, the underwriters set a price for the shares. This price can change based on how much interest there is during a pre-IPO roadshow, where the company shows off its plans to big investors.

- Regulatory Filings: The company has to file a detailed document called a prospectus with the regulators, like the Securities and Exchange Board of India (SEBI) or the U.S. Securities and Exchange Commission (SEC). This document shares important details like financial statements, the company’s plans, risks, and how it will use the money from the IPO. This ensures that investors know what they’re getting into.

- Subscription and Allocation: When the IPO opens, both big investors and regular people can apply for shares. If more people want shares than are available, the shares are given out based on a lottery or a proportional system. If not enough people are interested, the underwriters might buy the leftover shares.

- Listing on Stock Exchanges: Once everything is done, the company’s shares are listed on a stock exchange, like the Bombay Stock Exchange (BSE) or the New York Stock Exchange (NYSE). Now, anyone can buy or sell the shares, and the price will change based on how many people want to trade them.

How to Apply for an IPO in India

Applying for an IPO in India is a straightforward process, even if you’re new to investing. The key requirements are a Demat account and a trading account—both necessary to buy and hold shares electronically. Here’s your step-by-step guide on how to apply for an IPO in India, whether you’re a beginner or a seasoned investor.

1. Open a Demat and Trading Account

Before you can apply for an IPO, you’ll need to open a Demat account and a trading account. These accounts are available through SEBI-registered brokers or banks and are essential for holding shares electronically and placing orders. The Demat account keeps your shares safe, while the trading account allows you to execute buy and sell orders. Choose a broker that suits your needs—many brokers offer user-friendly platforms for first-time investors.

2. Log into Your Trading Account

Once your Demat and trading accounts are active, log into your trading platform (either through the broker’s website or mobile app). Most brokers provide a dedicated IPO section detailing all ongoing or upcoming IPOs. This section will list the available IPOs, including information like the IPO price, company details, and the application process.

3. Choose the IPO You Want to Apply For

Browse through the list of IPOs and select the one you’re interested in. Before committing, take the time to read the company’s prospectus. This document contains key details, including the company’s financial performance, risk factors, and the price band (the range within which the shares are offered). The prospectus will help you decide if this IPO aligns with your investment goals.

4. Enter Your Bid Details

Once you’ve selected the IPO, it’s time to place your bid. Here’s where you’ll choose the number of shares you want to apply for and the price you’re willing to pay. You can either specify a price within the price band or opt for the cut-off price, which means you’ll accept the final price determined by the company after the IPO closes.

The bidding process can vary slightly depending on whether you’re applying for a retail or non-retail (institutional) share. For retail investors, you can bid for shares in lots (multiple shares).

5. Select Your Payment Method

When applying for an IPO in India, you’ll typically have two options for paying:

- UPI (Unified Payments Interface): UPI has become a popular method for IPO applications. After you enter your bid, the platform will prompt you to approve the payment request via your UPI app (such as Google Pay, PhonePe, or Paytm). Once you authorize the payment, the money will be blocked from your account until the allotment process is complete.

- ASBA (Application Supported by Blocked Amount): With ASBA, the application amount is blocked in your bank account rather than deducted upfront. If you get an allotment of shares, the amount will be debited from your bank account. You can apply for an IPO via your bank’s net banking portal, where the ASBA option will be available.

6. Submit Your Application

Once you’ve reviewed your bid and payment details, double-check everything and submit your application. Be mindful of the application window—for UPI-based applications; you must complete the authorization before 12 PM on the day the IPO closes. If you’re using ASBA, the funds will stay blocked until the allotment process is confirmed.

7. Wait for Allotment

After submitting your IPO application, the next step is to wait for the allotment. This process involves allocating shares based on demand. A lottery system will determine who gets the shares if the IPO is oversubscribed (i.e., more people apply than shares available). You can check the allotment status on the registrar’s website (such as KFintech or Link Intime) to see if you were successful.

8. Check for Allotment and Listing

Once the allotment process is complete, the shares you were allocated will be credited to your Demat account. The blocked funds will be returned to your bank account if you don’t receive an allotment. If you get the shares, they’ll be listed on the stock exchange once trading begins, and you can start buying or selling them.

Risks of IPO Investments

Investing in Initial Public Offerings (IPOs) can be exciting and offer the chance for significant returns. However, it’s important to know that there are risks involved. Here are some key risks you should be aware of before jumping into an IPO:

Volatility in Stock Prices After Listing

After a company goes public, its stock price can swing wildly, especially during the first few days of trading. This happens because of the uncertainty around how many people want to buy or sell shares. The initial buzz around an IPO might cause prices to shoot up or drop quickly, leading to losses if you’re not ready for these price changes.

For example, while some stocks might rise sharply after they start trading, others could drop below their original price, meaning you could lose money if you bought shares during the IPO.

Uncertainty Regarding Company Performance

When you invest in an IPO, you’re betting on how well the company will do in the future. However, predicting a company’s success can be tricky, especially for new or less-known firms. Even if a company seems to have excellent growth potential, things can go wrong—like market downturns, new regulations, or tougher competition—that could hurt its performance.

Just because a company is going public doesn’t mean it will automatically meet its earnings expectations, leaving you vulnerable if it doesn’t perform as well as hoped.

Limited Historical Data

Unlike older public companies that have years of financial data and a track record to review, IPO companies usually don’t have much history available. This makes it challenging for investors to evaluate how profitable the company might be or how well it could handle economic ups and downs in the future.

Liquidity Risk: Difficulty in Selling Shares

Another risk to consider is liquidity, a fancy word for how easy it is to sell your shares. Sometimes, after a stock is listed, more people might want to sell than buyers. This can make it hard to sell your shares, especially if the company isn’t performing well or if the market mood turns sour.

In such cases, the stock might not trade much, making it hard to sell at a reasonable price. In the worst situations, you could have to sell your shares for much less than you paid, resulting in potential losses.

How to Analyze an IPO Before Investing

Investing in an IPO can be exciting, but before you take the plunge, you must do your homework. Analyzing an IPO involves examining key factors influencing the company’s long-term performance and profit potential. Here’s how you can effectively evaluate an IPO before deciding to invest.

Examine the Company’s Financial Health

A company’s financial health is the foundation of any investment decision. Strong financials indicate that the company can weather economic challenges and continue growing. To assess its financial stability, focus on the following:

- Revenue Growth: Has the company shown consistent revenue growth over time? Steady growth signals a healthy business with expanding market demand.

- Profit Margins: A company with healthy profit margins can manage costs and drive strong earnings. If profit margins are narrow, it might signal potential issues in cost control or market competition.

- Debt Levels: Check if the company is highly leveraged. While some debt can fuel growth, too much can be risky, especially if the company struggles to manage it. A high debt-to-equity ratio could limit future growth potential and cause financial strain.

A solid financial foundation with consistent revenue, strong profitability, and manageable debt levels indicates an IPO worth considering.

Evaluate the IPO Valuation

The company and its underwriters set the IPO price, but that doesn’t mean it’s always a fair value. To determine if the stock is overvalued or reasonably priced, you need to analyze the company’s valuation metrics:

- Price-to-Earnings (P/E) Ratio: The P/E ratio shows how much investors are willing to pay for each unit of earnings. Compare this ratio to competitors in the same sector. If the ratio is excessively high, the stock may be overpriced.

- Other Valuation Ratios: Consider metrics like Price-to-Book (P/B) and EV/EBITDA to evaluate how the market values the company compared to its peers. If the IPO is priced too high, it could mean that the stock is overhyped and may face a sharp drop post-listing.

- Comparable Companies: Look at the valuations of similar companies in the same sector. If the IPO price is significantly higher than the sector average, it might indicate inflated expectations.

A balanced, well-researched valuation ensures you’re not overpaying for shares, which could reduce the chances of your investment’s value dipping after the listing.

Assess the Growth Potential

Investing in an IPO is all about future potential. To gauge how much room a company has to grow, consider its industry and competitive positioning:

- Industry Trends: Is the sector experiencing growth? A booming industry can offer companies a broader market, increasing their chances of success. If the industry declines, the company’s growth prospects might be limited.

- Market Position: What competitive advantages does the company hold? Look for signs that the company has a unique product, service, or market niche that will allow it to capture market share in a growing sector. A strong brand, intellectual property, or cost leadership are all examples of competitive advantages that can fuel future growth.

Understanding the company’s position within its industry and its growth potential will help you determine whether it’s poised to thrive or face difficulties.

Investigate Management Quality

The leadership of a company can significantly influence its performance post-IPO. A capable, experienced management team is often the difference between success and failure. To evaluate the management team, look for:

- Track Record: Has the management team led other businesses or executed IPOs? A team with a proven history of success in building businesses or navigating public markets is more likely to drive future growth.

- Experience in the Industry: Does the management have deep expertise in the industry? Leaders who understand the nuances of their sector and have a clear strategy for growth can make better decisions to drive value for shareholders.

Good leadership can guide the company through its IPO and beyond, ensuring long-term sustainability and growth.

Dive into the Draft Red Herring Prospectus (DRHP)

The Draft Red Herring Prospectus (DRHP) is your primary research tool when evaluating an IPO. This document contains a wealth of information, including the company’s business model, financial performance, and risk factors. Here’s what to focus on:

- Business Overview: Understand the company’s products, services, and market. Does the business have a strong foundation or depend on a few products or markets?

- Financial Performance: Look at the company’s historical financial data, including revenue, profit, and growth trends. Any unusual fluctuations or inconsistent performance could be a red flag.

- Risk Factors: This section outlines the potential risks the company faces. Pay attention to significant risks, such as dependency on a single product, a competitive market, or regulatory hurdles that could hinder growth.

- Objectives of the IPO: Understand how the company plans to use the funds raised from the IPO. Are they using it to pay down debt, expand operations, or invest in innovation? A clear plan for using IPO funds effectively is crucial for long-term value creation.

The DRHP gives you a detailed look at the company’s operations, risks, and strategy. Carefully reviewing it can help you make a more informed decision.

What Are the Types of IPOs in India?

When a company goes public in India, it typically offers its shares through one of two main types of Initial Public Offerings (IPOs): Fixed Price IPOs and Book Building IPOs. While both serve the same purpose of raising capital, they differ in how the share price is set and how investors place their bids. Let’s explore each type in detail.

Fixed Price IPO

A Fixed-price IPO is the simpler of the two types, where the company sets a predetermined price for its shares. This price remains fixed for all investors, providing transparency and certainty regarding the cost per share.

How It Works:

In a Fixed-price IPO, the company and its underwriters determine the share price before the offering is made. This price is usually based on the company’s financials, market conditions, and overall valuation. Once the price is set, investors can apply for shares at that fixed price during the subscription period.

Key Features:

- Price Transparency: Investors know exactly how much they’ll pay per share, making it easy to evaluate the investment.

- Subscription: If demand for shares exceeds supply (i.e., the IPO is oversubscribed), shares are allotted proportionally based on the number of applications. This means that each investor may receive a smaller allocation than requested if the IPO is in high demand.

For investors seeking simplicity and certainty, a Fixed-price IPO offers a clear approach with minimal ambiguity regarding pricing.

Book Building IPO

A Book Building IPO, on the other hand, introduces more flexibility and market-driven pricing. Rather than setting a fixed price, the company provides a price band for investors to place bids. The demand at various price levels determines the final price of the shares.

How It Works:

In a book-building IPO, the company and its underwriters decide on a price band—a range of prices within which shares will be offered. This range consists of a floor price (the minimum price an investor can bid) and a cap price (the maximum price). Investors can then place bids within this range, indicating how many shares they want and at what price.

After the subscription period ends, the company assesses the bids received and sets the final issue price, often called the cut-off price. The cut-off price is determined by the demand for shares at different price points, ensuring that the market helps establish a fair value for the company.

Key Features:

- Dynamic Pricing: The final price of shares is based on demand, which means investors may end up paying more or less than the initial floor price, depending on how many shares they bid for and at what price.

- Price Discovery: The bidding process allows investors to help determine the fair market value of the company’s shares. The final price reflects the collective judgment of the market.

- Floor and Cap Price: These two prices set the boundaries for bidding. The floor price is the minimum amount an investor can bid, while the cap price is the maximum.

In a Book Building IPO, investors can place bids at different prices within the given band, offering a more nuanced approach to pricing and share allotment. The final share price results from market-driven demand, potentially more accurately reflecting the company’s value during the IPO.

Key Differences Between Fixed Price and Book Building IPOs

- Pricing Method: Fixed-price IPOs offer certainty, as the share price is already determined. Book Building IPOs allow the market to set the price through bids.

- Flexibility: Investors in Book Building IPOs can bid at various price points within the range, while Fixed Price IPOs offer no such flexibility.

- Market Sentiment: Book-building IPOs are more reflective of current market conditions, as the final price is driven by investor demand. Fixed-price IPOs, on the other hand, are set regardless of market sentiment.

Fixed-price IPOs and Book Building IPOs have advantages, and the best choice depends on the investor’s preferences and market conditions. Fixed Price IPOs offer simplicity and certainty, while Book Building IPOs provide flexibility and better price discovery. Understanding the nuances of each type can help you make a more informed decision when participating in an IPO.

What Is the Grey Market and How Does It Affect IPO Pricing?

The grey market refers to an unofficial, informal marketplace where investors trade shares of an upcoming Initial Public Offering (IPO) before the company is officially listed on stock exchanges like the NSE or BSE. Although not regulated by the Securities and Exchange Board of India (SEBI), the grey market provides valuable insight into investor sentiment and demand for an IPO, giving an early glimpse of how the stock might perform once it hits the exchange.

What Is the Grey Market?

The grey market operates outside the formal structures of official stock exchanges, and transactions occur directly between investors or through intermediaries known as grey market dealers. These dealers buy and sell IPO shares based on speculation about how the stock will perform once it is listed. It’s a way for investors to take positions in the IPO before its public debut.

How It Works:

Investors looking to participate in an IPO may approach grey market dealers to buy or sell shares at a price set by supply and demand. Since these transactions happen off the official radar, they are based on mutual trust rather than any legal framework. The trades are speculative, meaning they depend on how the market perceives the future performance of the IPO.

Grey Market Premium (GMP)

The Grey Market Premium (GMP) is the difference between the price at which shares are traded in the grey market and the official issue price set by the company for its IPO. The GMP is a key indicator of market sentiment—whether investors are optimistic or skeptical about the stock’s future performance once it is listed.

Significance of GMP:

- High GMP: A significant GMP indicates strong demand for the IPO shares, suggesting that investors expect the stock to perform well once listed. For example, if the IPO price is ₹100 and the GMP is ₹30, this implies that investors expect the stock to trade around ₹130 on the listing day.

- Low or Negative GMP: A low or negative GMP suggests weak investor sentiment, which may indicate a less favourable reception of the IPO. This could lead to lower demand, making the stock underperform after listing.

The GMP offers a quick snapshot of how the market perceives the upcoming IPO, but it’s important to note that the GMP is not always accurate and should be interpreted with caution.

Risks of Participating in the Grey Market

While the grey market can provide valuable insights into IPO demand, it carries significant investor risks. These include:

- No Legal Recourse: Since grey market trades are unofficial and unregulated, investors have no legal protection if something goes wrong with the transaction. If a trade is not fulfilled as agreed, no regulatory body can resolve the dispute.

- Price Manipulation: The grey market is susceptible to price manipulation, as market speculators may artificially inflate or deflate the Grey Market Premium to influence investor sentiment. This can lead to distorted prices that may not reflect the actual value of the IPO.

- Lack of Transparency: Unlike official stock exchanges, where transactions are publicly disclosed, the grey market operates in secrecy. This lack of transparency makes it difficult to assess the actual demand or determine the fair value of shares before they are officially listed.

How Does the Grey Market Affect IPO Pricing?

Though not officially part of the IPO process, the grey market can substantially influence how investors perceive the IPO’s pricing and demand. Here’s how:

- Impact of a High GMP: A high GMP often generates positive sentiment about an IPO. It creates a buzz, leading more retail and institutional investors to apply for the IPO. This increased interest can lead to oversubscription, making it likely that the stock will perform well on its listing day. Investors tend to view a high GMP as an indication of strong demand, often resulting in favorable initial trading conditions.

- Impact of a Low or Negative GMP: A low or negative GMP can have the opposite effect. It might signal weak interest or skepticism surrounding the IPO, leading to lower demand and a potentially disappointing listing performance. This could result in the stock trading below its issue price on the listing day, affecting both investor sentiment and the IPO’s long-term prospects.

While the grey market offers early indicators of investor expectations, it operates in an unregulated and speculative environment. Investors should treat grey market data as a sign of potential demand but not as a definitive guide to how the stock will perform post-listing. Always conduct thorough research and consider all factors before making investment decisions.

Frequently Asked Questions (FAQ)

What is an IPO?

An Initial Public Offering (IPO) is when a private company offers its shares to the public for the first time, allowing everyday investors to buy ownership in the company.

Why do companies go public through an IPO?

Companies go public to raise capital for expansion, pay off debt, fund research and development, or provide an exit opportunity for early investors.

What is the difference between a Fixed Price IPO and a Book Building IPO?

In a Fixed-price IPO, shares are offered at a predetermined price. In Book Building IPOs, investors can bid for shares within a price band, and the final price is determined based on demand.

What is a DRHP?

The Draft Red Herring Prospectus is a document filed with SEBI that contains detailed information about the company’s business, financials, risks, and how it plans to use the IPO proceeds.

What is the Grey Market Premium (GMP)?

GMP is the premium amount at which IPO shares are traded in the unofficial market before they are listed on the stock exchange. It indicates market sentiment about the IPO.

How can I apply for an IPO in India?

To apply for an IPO, you need:

- A Demat account

- A trading account

- UPI ID or ASBA facility

You can then apply through your broker’s platform or bank’s website.