Imagine you’re in a grand casino. The lights are bright, the chip stacks are towering. You notice a massive crowd piling onto one table, absolutely convinced they’re about to hit the jackpot.

But look closer.

Observe the pit boss, the one who set the odds for the house. He is quietly taking his personal winnings off the table and heading for the exit.

That, in essence, is the Lenskart IPO.

On the surface, it appeared to be a blockbuster. The offering closed with a staggering 28.26x oversubscription, sending retail investors into a state of euphoria. But underneath this flood of subscription cash, a crucial indicator was collapsing: the Grey Market Premium (GMP). source

This is the financial story of brilliant business execution priced at an absurd valuation, and how founder timing can become the loudest warning signal of all.

A Founder’s Perfectly Timed Exit

Let’s be candid: this IPO was less about raising capital for the company’s future and more about securing capital for its past.

Out of the massive ₹7,278 crore issue size, nearly 70% was an Offer for Sale (OFS). This is simply the formal mechanism for existing shareholders to cash in their chips. source

Only 30% of the raise was fresh money earmarked for Lenskart’s expansion. When seven out of every ten rupees raised goes directly to existing owners, it forces one to question who, exactly, truly benefits from this timing.

The star of this exit is none other than Peyush Bansal.

The founder personally sold 2.05 crore shares at the upper price band of ₹402, pulling in approximately ₹824 crore. source

Consider the math: Bansal likely acquired those same shares for around ₹18-20 each. This move crystallizes a 20-22x return, locking in roughly ₹806 crore in pure capital gains. He is diluting over 91% of his founder stake in one strategic maneuver.

Herein lies the delicious irony. This is the same Peyush Bansal who sits on Shark Tank India as a panelist, grilling founders about their valuations and rejecting deals that seem overpriced. Yet, his own company’s IPO is priced at a 235x P/E multiple, a valuation he would almost certainly reject if another entrepreneur dared to pitch it on his show.

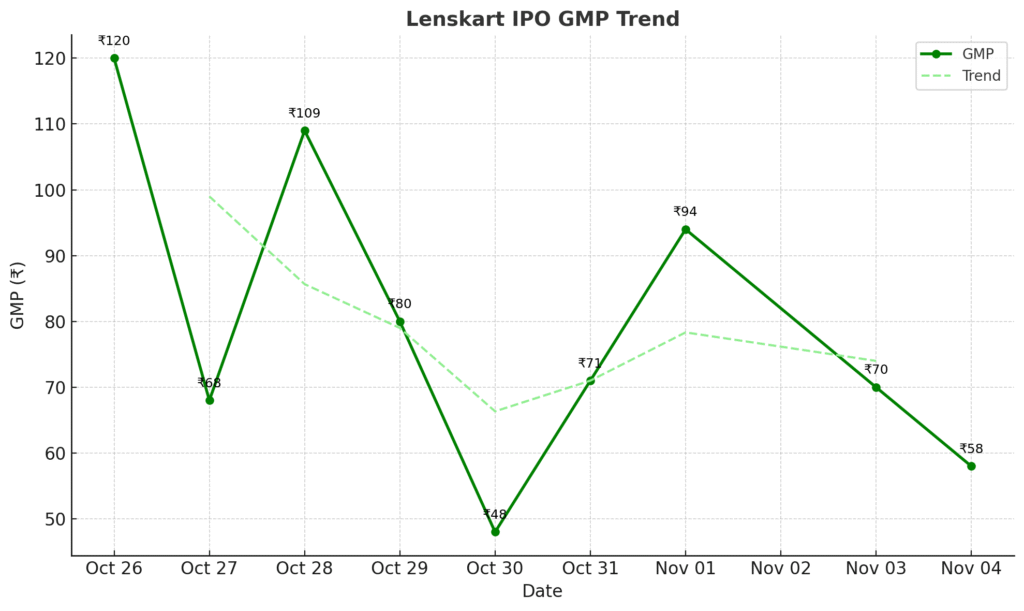

When the Grey Market Speaks, Listen

While the retail masses were piling into the IPO, sophisticated traders in the grey market were doing the exact opposite: quietly selling off their pre-listing claims. The GMP is the best real-time indicator of listing-day sentiment because it involves traders with actual skin in the game.

Their verdict was devastating.

The GMP peaked near ₹120 on October 26, representing a 30% premium that suggested massive listing day gains. But by the time the IPO closed on November 4, it had plummeted to just ₹58. source

That brutal 66% collapse in just nine days wasn’t a minor correction; it was sophisticated money running for the exits.

This divergence tells you everything. The public was betting on euphoria, but the traders capable of adjusting their valuations in real-time were betting on modest gains at best.

Even more telling, Lenskart’s own employees subscribed at a paltry 2.62x, a definitive canary-in-the-coal-mine signal from those who understand the internal machinery best.

The Price of Global Growth

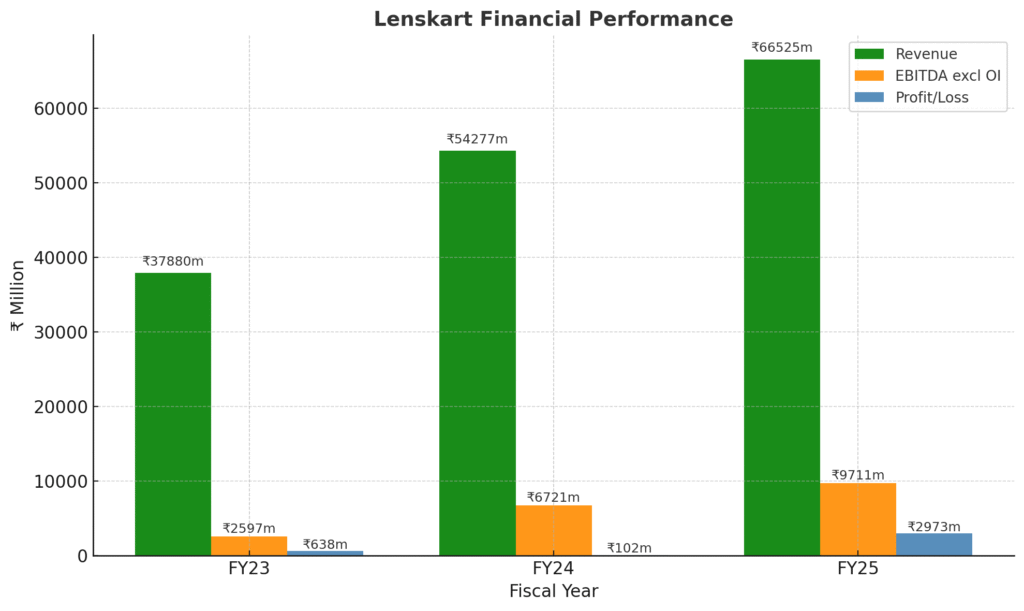

Lenskart’s growth trajectory is genuinely impressive. Revenue climbed from ₹37,880 crore to ₹66,525 crore over two years, and the company has built a legitimate, market-leading position.

But when you dig into the segment performance, some troubling patterns emerge.

The company operates in two distinct markets: India and International. On the surface, international operations look superior with product margins of 74%, nearly twelve points better than India’s 63%.

But here’s the catch: international stores represent only 24% of the store base while generating 40% of the revenue. This means each international store requires significantly more capital but delivers lower productivity. As Lenskart scales internationally, expect margin dilution and elevated capital requirements. This combination threatens to crush returns on invested capital.

Speaking of capital intensity, the numbers reveal a worrying acceleration. Property, plant, and equipment jumped 42% year-over-year. The business is becoming more capital-intensive, not less. With plans to expand from 2,723 stores to over 5,000 globally, this trajectory threatens to consume all the cash flow the business generates. source

Then there’s the Dealskart acquisition, completed just three days before the IPO closed. Major integrations during an IPO season add significant execution risk, precisely when investor confidence is paramount. The timing suggests the company needed to clean up its structure before going public, even if it meant adding complexity at the worst possible moment.

A Valuation Built on Dreams

The market opportunity is undeniably real. India’s eyewear market is valued at $28.2 billion, with 777 million Indians needing corrective eyewear today. Lenskart has captured 46% of the organized retail market. This is a real business solving a real problem. source

But at a ₹70,000 crore valuation, investors are paying an extraordinary premium.

Consider the P/E ratio of 235-238x. Essilor Luxottica, the global eyewear giant with proven margins and worldwide scale, trades at 57x. Even Warby Parker, the US digital darling, trades at 89x. You are being asked to pay four times more for Lenskart’s earnings compared to established global leaders.

The Price-to-Sales ratio of 10.5x is nearly double the global standard. And at an 11x Price-to-Book ratio, you’re paying ₹11 for every ₹1 of equity value in a company whose growth has already decelerated from 43% to 23% year-over-year. source

The most damning metric, however, is buried in the footnotes: Return on Capital Employed (ROCE) sits at just 13.84%. This is below the typical 14-18% cost of capital that institutional investors demand. It implies that every rupee of incremental capital deployed may not generate an adequate return. You are essentially funding an expansion that risks destroying shareholder value.

Here’s the real problem with that glossy ₹2,973 crore net profit figure for FY25: it includes a massive ₹1,672 crore one-time gain from revaluing a previous acquisition.

Strip that non-operational item out, and core profit is approximately ₹1,300 crore, significantly lower than the headline numbers suggest.

The mathematics are unforgiving. For Lenskart to justify its ₹70,000 crore price tag, the company must achieve over 20% annualized earnings growth for the next five to seven years. It must do this all while deploying massive capital, integrating Dealskart, managing international margin dilution, and battling a growth rate that’s already slowing.

The Good News in the Fine Print

To be fair, Lenskart has built genuine operational excellence.

Store economics are healthy; over 80% of new stores achieve payback within an average of 10.29 months. Working capital efficiency has improved dramatically, with the company now collecting cash and paying suppliers in under 26 days (down from 35). source

Operating cash flow grew 152% year-over-year, proving the business generates real cash, not just accounting profits. The company serves over 12 million customers, has surpassed 100 million app downloads, and has decreased its debt by over ₹512 crore. These are the marks of a genuinely well-run business with defensible competitive advantages.

The problem isn’t the business; it’s the price.

Here’s What I Think

The IPO lists on November 10, 2025. The opening hours will reveal whether retail euphoria or institutional skepticism wins the day.

If the stock lists with only 15-20% gains (consistent with the final ₹58 GMP), expect consolidation or a near-term pullback as sophisticated sellers exit into retail buying. If it gaps up significantly above 20%, that is retail momentum overwhelming fundamental concerns, a pattern historically associated with subsequent corrections.

Watch for anchor investor selling after the mandatory 30-90 day lock-in expires. Monitor the first quarterly results to see if the operational trajectory matches the valuation’s lofty expectations. And most critically, track capital expenditure. If it continues at this elevated pace, the profit levels you’re paying for today will be impossible to maintain.

Lenskart has built a world-class machine with superior efficiency, healthy store economics, and a defensible market position.

But at ₹70,000 crore, that machine is priced not for excellent execution, but for perfection.

The founder’s ₹824 crore exit, coinciding with the 66% collapse in grey market premium, creates a clear market dichotomy: retail euphoria clashing head-on with sophisticated skepticism. When the insiders are sprinting out the door while employees show only tepid interest, it is rarely a sign that things are about to get better for those running in.

A great business at a terrible price is still a terrible investment.

Disclaimer: The information shared by Stock Marcat is for educational and informational purposes only and is based on publicly available data and analyst research. It should not be considered financial, investment, or legal advice. Stock Marcat is not a SEBI-registered advisor and is not responsible for any losses arising from actions taken based on this information. Please consult a qualified financial advisor before making investment decisions.